38 Interesting Payroll Facts and Statistics You Should Know

A business’s financial and administrative operations depend heavily on payroll. It’s crucial to have a solid system in place when running a business so that you can accurately measure employee hours. Payroll errors can be expensive and can foster a culture of uncertainty within your company.

Even worse, errors in employee time tracking leading to inaccurate payouts can result in compliance problems, putting you at risk of paying substantial fines. By analyzing general payroll statistics and trends, businesses can anticipate when certain workforce schedule changes may start to affect them.

This article will provide business owners the chance to prepare in advance and discover more inventive solutions that can prevent unnecessary payroll expenses, boost employee morale, and reduce administrative burdens. Continue reading to discover 38 payroll facts, statistics, and trends that will help you install a flawless payroll system into your company.

01Payroll facts and trends

In the United States, biweekly is the most common pay frequency.

Despite great progress toward pay equality in 2022, women still earn 17% less than men on average.

Harvard Business Review

When automated timekeeping and payroll are combined, error rates are reduced by almost 67% compared to firms that only automate.

Zenefits

There are 52 workweeks in a year, with typical pay frequencies as follows:

Weekly: 52 payroll weeks

Biweekly: 26 payroll periods

Semi-monthly: 24 payroll periods

Monthly: 12 payroll periods

U.S. Bureau of Labor Statistics

62% of companies use cloud payroll systems — an increase from 34.8% in 2019.

Alight

About 83% of employers provide their employees with a self-service portal to access pay and benefit information online.

American Payroll Association

60% of employed Americans want employers to offer workers immediate access to daily earned wages.

CPA Practice Advisor

The lowest average salary for any full-time job in the U.S. is $25,160 per year.

U.S. Bureau of Labor Statistics

In 2021, companies offering work-from-home allowances rose from 36% to 59%.

Alight

Earned wage access (EWA) programs are currently used by 10% of businesses, and by 2023, it’s anticipated that 20% of businesses with a majority of hourly workers will have adopted them.

The Clearing House

02Small business payroll statistics

60% of small businesses still handle payroll in-house.

Software Advice

Nearly 70% of small businesses say payroll taxes are a moderate to significant burden.

National Federation of Independent Business

Due to shifts in employment, more than 61% of small firms suffer varying payroll cash outflows.

JP Morgan Chase

54% of firms state there is room for improvement in their current payroll policies and practices.

EY

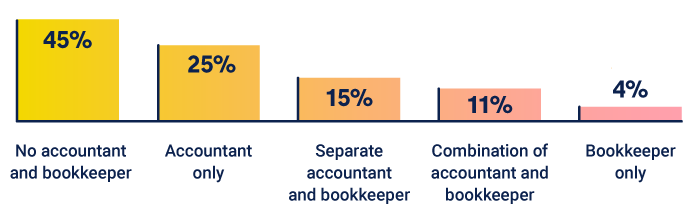

25% of small businesses handle their finances on paper rather than a computer, and 45% don’t even have an in-house accountant or bookkeeper.

40% of small business owners say bookkeeping and taxes are the worst and most time-consuming part of owning a business.

SCORE

30% of businesses misclassify their employees as independent contractors to save on taxes.

NHPCO

03Payroll outsourcing statistics

61% of companies have outsourced some or all of their payroll operations.

Payroll errors happen twice as frequently with in-house payroll compared to outsourced payroll.

CoAdvantage

62% of companies with six or more payroll providers incurred payroll-related fines within the last five years.

Alight

Businesses can save 20%-30% annually by hiring freelancers vs. in-house employees.

Hire

30% of firms stated they would strongly consider moving to a new payroll provider for a better user experience.

Zenefits

Businesses that outsource payroll save 18% compared to those that handle it themselves.

Software Advice

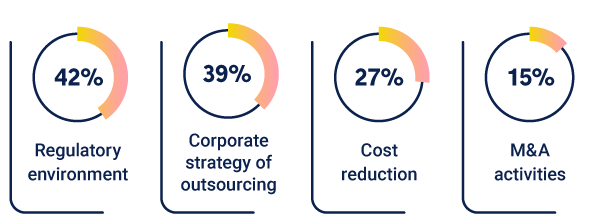

Key Drivers for Outsourcing Payroll:

Alight

04Employee payroll statistics

Nearly 65% of workers live paycheck to paycheck.

American Payroll Association

Direct deposit is used for payroll by 96% of workers.

After two paycheck problems, 49% of employees say they’ll start looking for a new job.

UKG

54% of Americans have experienced pay problems.

Workforce Institute

76% of employees believe health and life insurance are the top benefits offered by companies.

Alight

84% of workers anticipate getting paid more every year they work for their company.

Workforce Institute

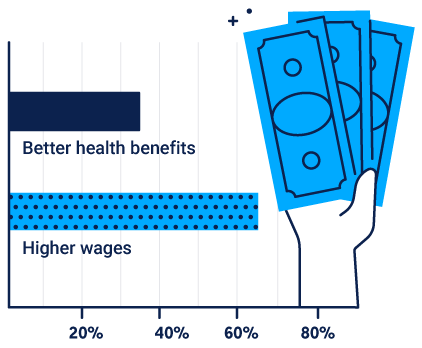

Over 65% of Americans state that higher wages are more important to them than better health benefits.

American Payroll Association

59% of employees state that salary was the primary factor that contributed to feeling fulfilled in their career.

SHRM

72% of Americans would experience financial difficulty if their paychecks were delayed by one week.

American Payroll Association

05Payroll statistics by industry

As of 2022, there are 59 million gig economy workers in the U.S.

Fortunly

Healthcare is the highest-paying industry, followed by engineering and information technology (IT).

There are over 153,000 employees on payroll in non-farm industries.

U.S. Bureau of Labor Statistics

Laundry and dry-cleaning is the lowest-paying industry, followed by food preparation and dishwashing.

USA Today

Healthcare and social assistance employ the most workers in the U.S.

EIG

As these payroll statistics show, payroll is an important aspect of your business that should never be overlooked. If you are an employer searching for a system that manages staff scheduling, time tracking, and payroll all in one location, ZoomShift is the solution for you.

Our payroll calculations take place down to the second and take in consideration the time range you choose, your employee wages during that time period, as well as your overtime settings.

The fact that ZoomShift integrates timesheets, staff schedules, and payroll ensures that all information loaded into the system is reflected in paychecks. This lowers the possibility of payroll errors while also boosting team confidence and employee retention.

Sign up for a free trial of our scheduling software to better manage your payroll and grow your business.

JD enjoys teaching people how to use ZoomShift to save time spent on scheduling. He’s curious, likes learning new things everyday and playing the guitar (although it’s a work in progress).