A Complete Guide to Restaurant Payroll With 5 Restaurant Payroll Software

The National Restaurant Association originally projected $899 billion for projected sales in 2020, but where those figures will actually land is anyone’s guess.

If the 2020 estimations end up being right, that means $270 billion in payroll should have been paid out, which is no small amount. That’s roughly the GDP of Finland or Chile.

Inevitably, a large portion of those payroll costs went to labor. It makes sense that the people responsible for keeping the restaurant operating at capacity would cost a lot, but how much is too much? And how can you get payroll costs under control in 2022?

For starters, it’s a good rule of thumb is to keep it at no more than 30% of sales. Any more than that, and you’re likely bleeding into your profit margin. From there, you can’t go wrong with following best practices and investing in the right technology:

1. Giving the World of Payroll Perspective

Payroll costs typically include the cost of both hourly and salaried employees, plus employee benefits. Employee benefits include but are not limited to payroll taxes, workers’ compensation insurance premiums, employee meals, transportation benefits, education expenses, group insurance, life insurance, and disability insurance.

The former is typically a straightforward calculation, even with overtime as a factor. The latter is a bit more complicated. Nevertheless, it’s important to make the effort to get the calculation right. In the restaurant world, payroll typically comprises non-exempt employees, more commonly known as hourly employees. The U.S. Department of Labor takes it a step further and has a classification for “tipped employees.”

Tipped employees engage in an occupation where they customarily receive more than $30 a month in tips. Non-exempt employees still need to be paid a minimum cash wage, but for “tipped employees,” that’s at least $2.13 an hour if their tips bring their rate to or above minimum wage.

If they don’t, a “tip credit” of $5.12 kicks into effect, which helps meet minimum wage requirements. It’s important to note that some local and state jurisdictions apply and require different cash wages.

2. Ensure Your Paperwork Is up to Par

There’s a lot of corporate red tape that goes into operating a restaurant, and there’s no shortage of legalese that you have to shift through to get people on the payroll.

When in doubt, consult with your attorney and accountant, but here’s a good list to get you started:

- Get an EIN number so you can properly file taxes for your business.

- Register as an employer with the state’s labor department.

- Ensure that your payroll system is withholding the correct percentages from employee income like local, state, and federal taxes + payments into Medicare, FICA, and Social Security.

- Get all new employees to fill out W4 forms so you know exactly how much to withhold.

- Get all new employees to fill out an I-9 to ensure they have proper citizenship and work authorization.

- Provide your payroll policy alongside your employee handbook so that everyone understands the payment schedule and terms.

- Set up employee benefits such as healthcare, paid time off, and retirement benefits (if applicable, of course).

This list may seem a bit overwhelming, but take comfort in knowing that most of these items are things that you have to fill out, create, or set-up only once.

3. Create a Foolproof Payment Schedule

An equally important payroll attribute is how frequently you pay employees. Each pay period frequency has its own set of pros and cons. For instance:

- Weekly pay periods are great for employees because they get paid more often but are more time-consuming for employers.

- Bi-weekly pay periods are good for employees and are more efficient, but they can get complicated when there’s a month with three pay periods. The 27th check gets tricky with employer contributions and tax and benefit implications.

- Monthly pay periods are cost-effective and time-saving but are tough on employees who lack budgeting skills.

In the restaurant industry, you can sometimes get away with longer pay periods if there’s a considerable amount of tips coming in, but it’s still a decision to consider carefully. Whatever you do, make it easy on everyone by offering direct deposit and easy-to-understand paycheck stubs, so there’s little to no confusion or mixups come payday.

4. Get Ahead of Potential Payroll Tax Issues

The time to prepare for taxes is on day one. If you set up the right systems from the beginning, then tax season is a breeze. If you skip over the details and aren’t tax compliant, you’re going to have a rough go of things.

For starters, you have to have reporting on lock. Remaining legal in the eyes of the IRS comes down to accurate receipts, pay stubs, expenses, and more. While you’re at it, consult with an attorney to fully understand local labor laws and any penalties that are associated with breaking them.

Lastly, it’s wise to hold onto employee and payroll records, which include employee contact information, paystubs, timesheets, tax forms, and payroll tax forms. You’ll be glad you did if you ever get audited.

Also Read: Common Payroll Mistakes and Effective Ways to Avoid Them

5. Investing in Payroll Tech

One of the best things you can do to streamline payroll for your restaurant is to invest in time tracking and payroll software. ZoomShift stores vital information like timesheets makes it quick and easy to run payroll and helps you save on labor costs.

Doing things by hand is cumbersome, hard to scale, and results in quite a bit of human error. Left unchecked for too long, you could be leaving money on the table and making your life harder than it has to be.

Top 5 Restaurant Payroll Software

Here is a list of the five best restaurant payroll software we’ve identified to help you spend less time on payroll and more time running your restaurant.

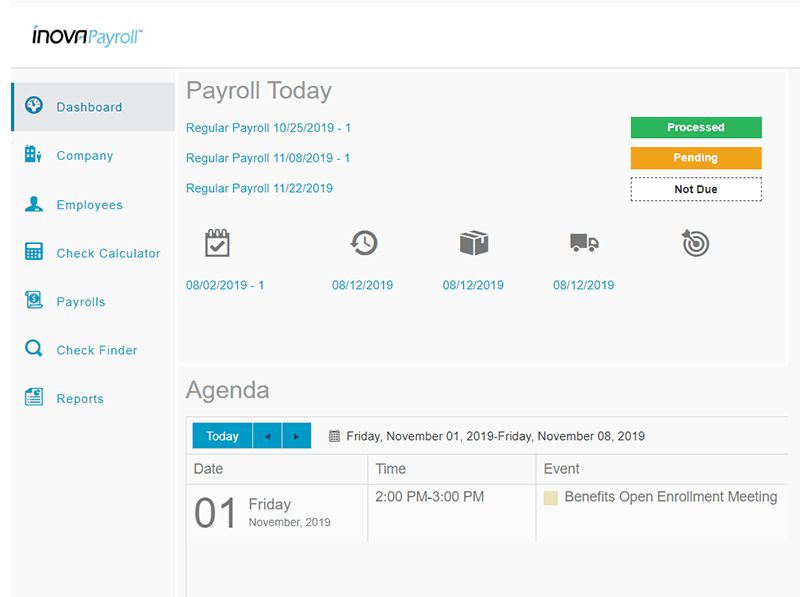

1. Inova Payroll

Inova Payroll serves businesses small and large. It offers small business solutions for companies with 1 to 50 employees and medium to enterprise solutions for businesses with 51 to over 1,000 employees. It was named a G2 High Performer in Small Business and Mid-Market for Spring 2021, and it’s been named one of the 5,000 fastest growing companies by Inc. five years in a row.

In addition to payroll, Inova the restaurant payroll software offers HR software, including recruiting and onboarding, benefits management, and performance management. This makes it an excellent solution for restaurants that want to streamline the entire employee lifecycle.

Inova Payroll also offers HR outsourcing for those looking for a higher level of support. And Inova’s early wage access solution helps restaurants recruit and retain staff by offering them access to earned wages on-demand between pay periods.

Inova Payroll’s features include:

- Unlimited earnings and deductions codes

- Full federal, state and local payroll taxes

- Ability to access multiple companies with one login

- Direct deposit

- Time off accruals

- Export reports to CSV or Excel

Inova Payroll’s pricing information is available via direct quote.

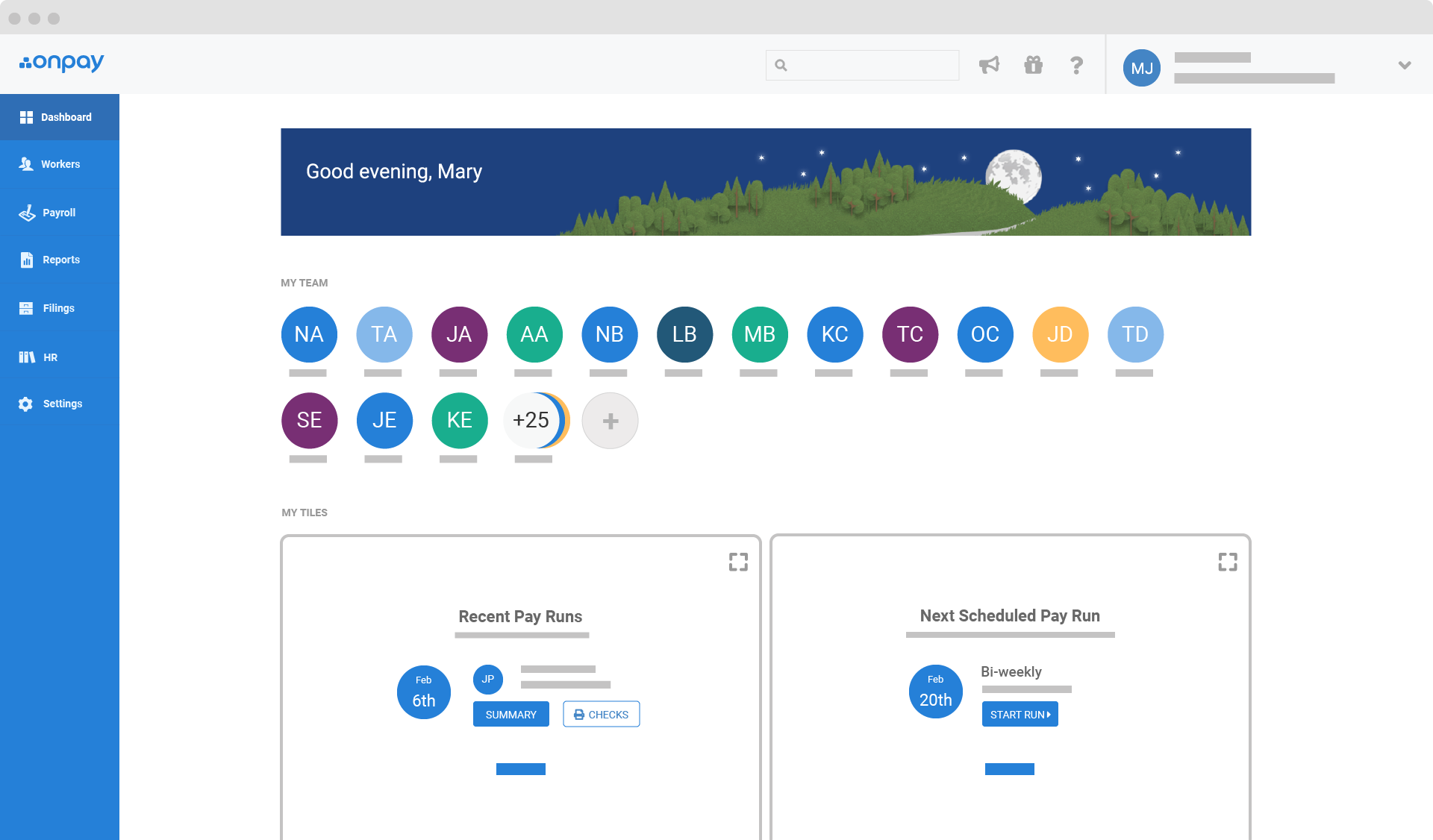

2. OnPay

OnPay is designed for people who want to spend more time running their business (and less on back-office tasks). Its award-winning payroll and HR saves business owners over 15 hours a month and free them up to focus on the bottom line. “It’s an easy, quick, mobile-friendly system that doesn’t require a steep learning curve,” according to Entrepreneur, and it was also PCMag’s Editors’ Choice. With OnPay, you can:

- Run payroll in minutes

- Automate all the taxes

- Let employees do more themselves

- Simplify your HR processes

- And offer top-notch benefits in any state

It’s just $36 plus $4 per person each month for everything OnPay does — easily the best value among premium payroll providers. The monthly fee includes best-in-class integrations with QuickBooks, Xero, and top time-tracking software, as well as all quarterly and year-end tax filings, and time-saving HR tools. OnPay’s team will even help you get set up by adding prior wages and employee information for you. You can add on integrated benefits, a 401(k) plan, or pay-as-you-go workers’ comp.

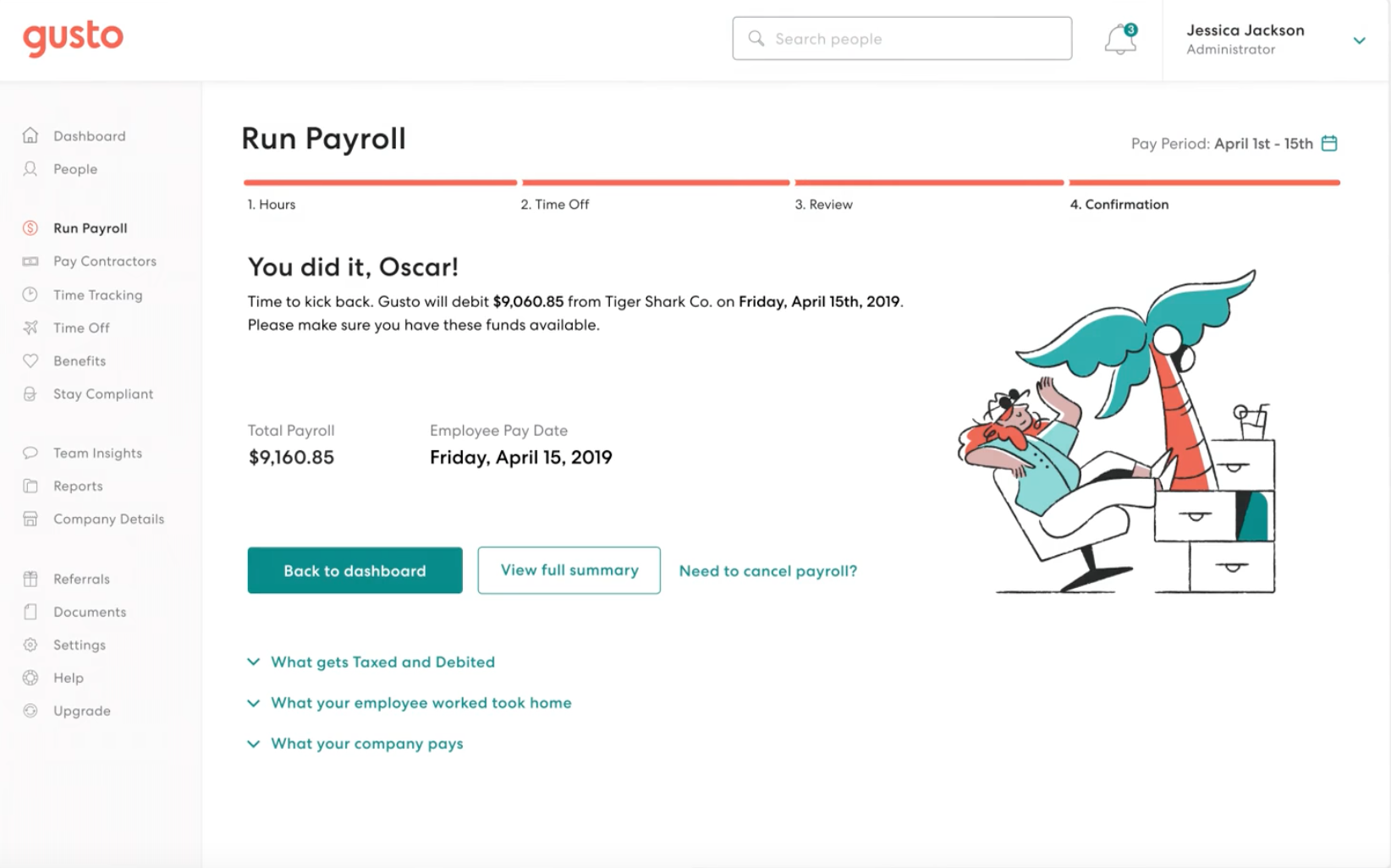

3. Gusto

Gusto is a popular restaurant payroll software, benefits, and HR software. It’s currently used by over 100,000 businesses and can help businesses make every part of the employee experience from onboarding to offboarding more pleasant and more efficient.

Plus, Gusto helps employees and contractors stay on top of their finances with helpful apps, like the Gusto wallet app, which helps employees track where the money from their paycheck is going. Employees can also use the Gusto debit card to get faster access to their cash.

Gusto’s features include:

- Automatic payroll tax filing

- Time and benefits tracking

- Integrates and syncs with other tools, like Xero, Clover, and QuickBooks

- Keeps track of important compliance info, like W-2s and 1099s

Pricing for Gusto starts at $6/person/month plus the $39/month base price and goes up to $12/person/month plus a $149/month base price at the highest level. There is also an option for businesses using contractors only, which is $6/person/month and no base price.

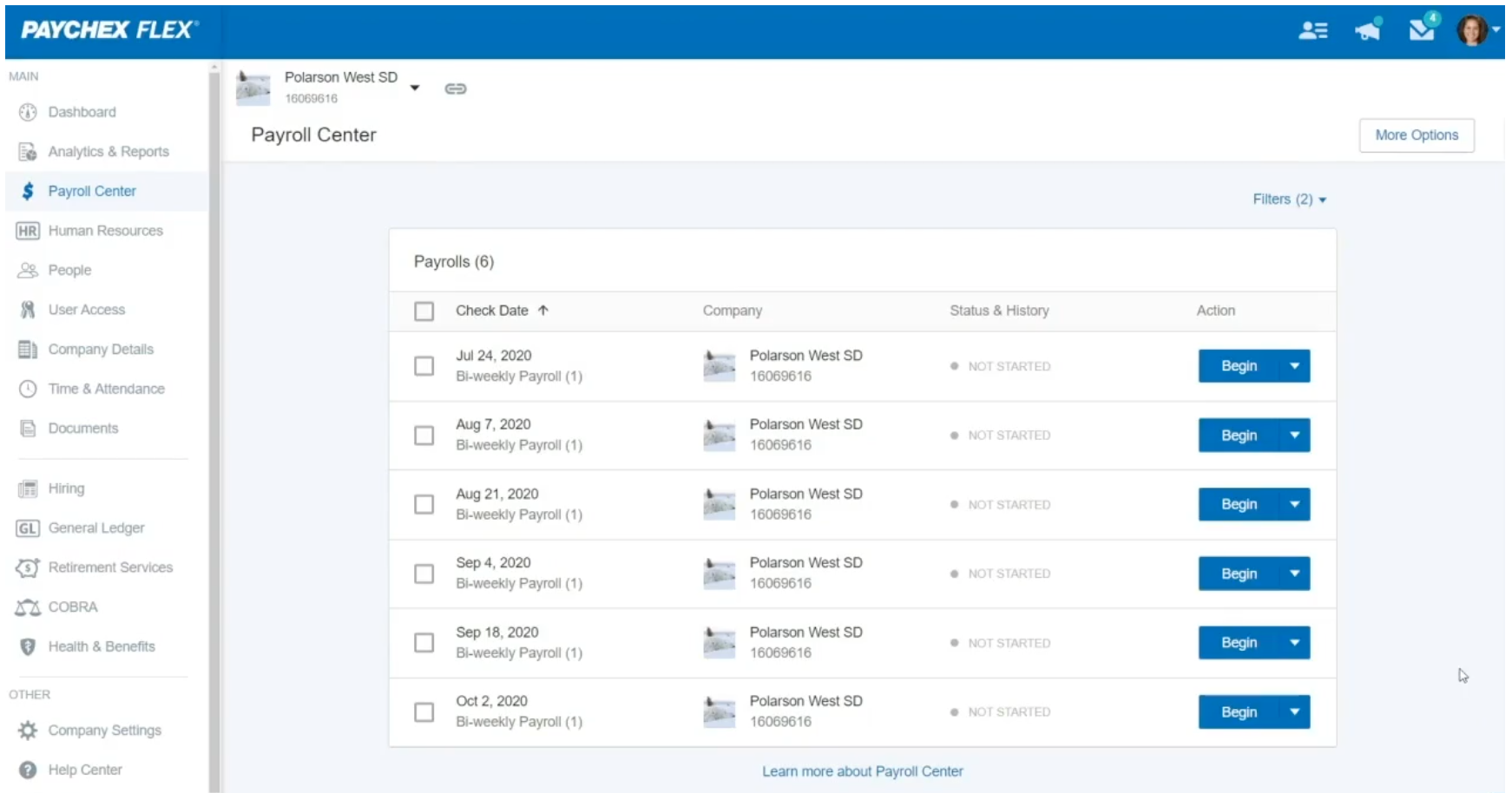

4. Paychex

Paychex offers several payroll tools that run the gamut from small business solutions to enterprise platforms. In addition to payroll software, Paychex also provides employee benefits, time clock, HR, and business insurance solutions, but these are all sold separately.

The company has been named one of the World’s Most Ethical Companies for 2020 by Ethisphere, and it is a Fortune Future 50 company as well.

One of the best parts of Paychex is its focus on customer service. Once you sign up with Paychex, you’ll have 24/7 access to trained professionals who can answer all of your questions and provide US-based help and support.

Paychex’s payroll solutions are split up by business size, but they all include features such as:

- Multiple payment options

- Online payroll processing

- Mobile app

- Employee access

To find out how much Paychex will cost you, you can get a quote from the company directly on their website.

5. SurePayroll

SurePayroll is a payroll software and a child company of Paychex. It has been in business for 20 years, and it was designed specifically to help small businesses. However, it also has an entire feature set dedicated to nannies and household helpers.

SurePayroll is built to be user friendly, so small business owners can expect to be up and running with a working payroll very quickly. US-based customer support is also available if you need help at any point.

Features include:

- Mobile app

- Employee benefit management

- Access to HR forms and workplace posters

- Payroll reports

Currently, SurePayroll pricing is only available via direct quote. However, due to the COVID-19 pandemic, the company is currently offering two months of free usage to small businesses.

If you’re interested in taking your restaurant’s employee management to the next level, try jumping right into a free trial of ZoomShift or schedule a demo with our sales team for more information.

JD enjoys teaching people how to use ZoomShift to save time spent on scheduling. He’s curious, likes learning new things everyday and playing the guitar (although it’s a work in progress).