Everything You Need to Know About Job Costing in 2024

Imagine that a lead contacts your contracting company and asks for a quote for the construction of a new house. You’re excited at the new prospect and sit down to come up with a reasonable but competitive quote.

But how do you figure out how much to charge for your work?

That’s where job costing comes in. Job costing is the process of determining how much your work will cost you to complete. From there, you can use that figure to price your products and services competitively.

In this guide, we’re going to cover the basics of job costing, including how to accurately estimate the expenses involved in a given job, when to use job costing, and more.

What Is Job Costing?

Job costing is the act or process of figuring out how much money it will cost you to complete a job. In other words, it’s a way of calculating the expenses you’ll accrue to provide a service or create a product.

Typically, job costing is used for custom orders or services, not long-term productions. For example, a caterer would need to do job costing when asked to prepare food for a party, but an electronics company wouldn’t necessarily consider a cost analysis of manufacturing their new game system an instance of job costing.

Job costing is important because it gives businesses an idea of how much they will be spending when completing a product or service. Consequently, it allows them to decide how much to charge for said service.

Without proper job costing, it’s easy to charge less for a product than it costs to make, leaving your business with a loss.

How to Calculate Job Costing

Now that you have a better idea of what job costing is all about, let’s take a look at how you can start to calculate the costs of your jobs.

Typically, this is divided into four steps (the order doesn’t need to be followed exactly):

Step 1. Calculate Direct Material

The simplest place to start is generally with direct material. This encompasses the cost of all the materials you will directly be using in your products and services.

For example, if you’re building a house, you might need cement, concrete, wood, insulation, etc. Calculate how much each of those will cost and add them up.

Be careful not to include indirect material costs, like tools you use to make your products. That’s a part of your overhead, not your direct material costs.

Step 2. Calculate Direct Labor

Next, calculate the cost of your direct labor. This includes all workers who are immediately and directly involved in bringing the product or service to fruition.

In the house building example, that would include all construction workers and contractors. However, it would not include supervisors or managers.

Step 3. Determine and Allocate the Overhead Rate

Overhead costs are the hardest to calculate because they are indirect expenses and can’t be easily divided up by projects. Examples of overhead costs include rent for an office, the cost of equipment, utilities, and manager salaries.

To make handling overhead expenses easier, many businesses calculate an overhead rate. This means that you add up your total overhead costs and then divide it by what’s called an activity driver, like labor hours. The key is to make sure your activity driver works for all your projects.

For example, if you pay $3,000 in overhead each month, and your laborers worked for 640 hours last month, you would divide the $3,000 by 640 to get $4.69 per labor hour (the overhead rate).

When you calculate the amount of labor you’ll need, just add on this cost to each hour of labor. This is referred to as allocating the overhead. Now you have an estimate of your overhead costs for the project.

If you use another activity driver, like manufacturing hours, the process remains the same.

What Is a Predetermined Overhead Rate?

Sometimes, businesses already have a flat rate they use for all their overhead costs. This is called a predetermined overhead rate.

Step 4. Add Everything Together

Once you’ve calculated your direct material, direct labor, and overhead costs, simply add everything together to get the estimated cost for the job.

Free Job Costing Template

Job Costing Example

Let’s walk through a real example to get a better feel for how this all works.

Imagine a small T-shirt printing company gets a custom order for a limited run of 1,000 T-shirts. How will it calculate the costs of this job?

First, it will add up the costs of the raw materials. The custom order is for 100% cotton T-shirts, so that is the only material involved. The company determines it costs $0.68 per T-shirt, so it will cost $680 for 1,000 T-shirts ($0.68 * 1,000).

Next, it will need to calculate the labor costs. It needs to employ one worker to operate the machinery for 6 hours to make the T-shirts. This worker is paid $15/hour, so that comes to $90.

After that, the company will need to calculate its overhead rate and allocate the overhead. If it paid $5,000 in overhead last month between rent, utilities, machinery, etc., it can divide this by an activity driver, like the total number of direct labor hours over the same period, to get an overhead rate.

So, if the company had 160 total direct labor hours, the overhead rate would be $31.25 per labor hour ($5,000/160 = $31.25). Then, it will allocate the labor to this job by multiplying the rate by the hours: $31.25 x 6 = $187.50.

Now, simply add up all these expenses to get a total job cost of $957.50 ($680 + $90 + $187.50).

Who Uses Job Costing?

Any kind of business can use job costing. However, it is most common among businesses that take custom orders. That means that construction companies, contractors, manufacturers, medical services, hair stylists, and other similar businesses will find job costing most useful.

Job costing is important to any business that relies on custom orders or limited manufacturing runs. The same process may be used by other types of businesses to determine costs, but they may not refer to it as job costing.

If you’re starting a new business, make sure you fully understand how to calculate the costs involved with your work so that you don’t end up losing money instead of making it.

Tracking Direct Labor Costs and Applied Overhead with ZoomShift

It’s not always easy to get a definitive figure for your costs. Not only are there varying elements to take into account (direct material, direct labor, overhead rates), but it can also be difficult to drill down into these areas and see exactly how much you’re spending.

Material costs can change quickly and your workforce works different hours at different rates, so where should you start when it comes to job costing?

A great place to begin is with scheduling.

If you don’t have a clear picture of how you’ll need to deploy your workforce, then it’s hard to understand what expenses you’ll incur. In many industries where job costing takes place, it’s important to have the right mix of people working at any given time.

For example, in a restaurant, you need chefs, waiters, bartenders, and supervisors to run efficiently. They all earn different rates and work different hours though, so this can make it difficult to forecast your costs.

This is where ZoomShift can make your life easier from the very beginning.

How ZoomShift’s Intelligence Scheduling Tools Give You Certainty

Scheduling a large workforce can be extremely challenging — it’s hard enough with a small workforce.

You’ve got to have the right people working in the right place at the right time, coordinate efficiently, and ensure everyone gets paid. If you’re doing this manually, then it can mean endless spreadsheets and lots of last-minute shift swapping.

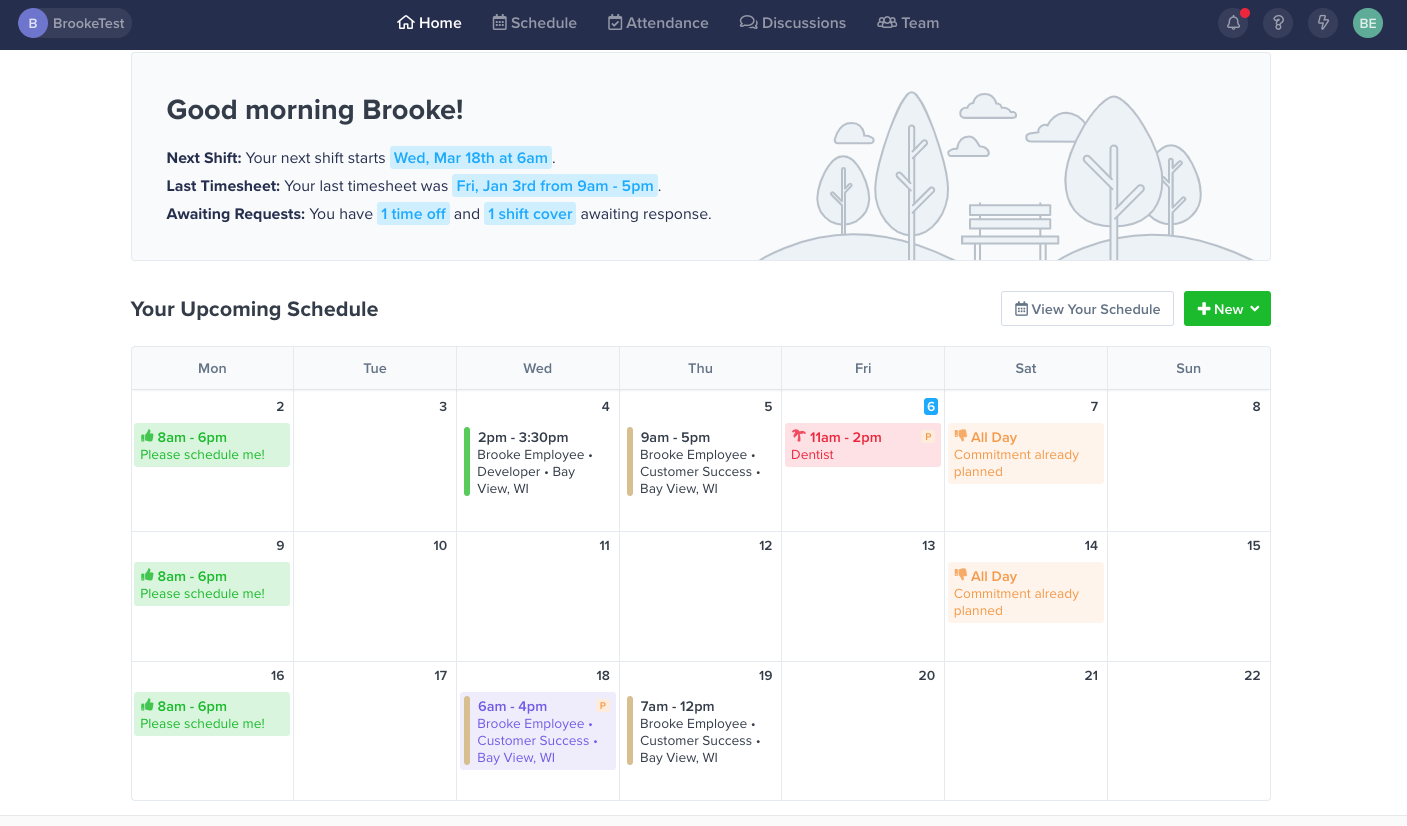

ZoomShift allows you to deploy your team more effectively by creating optimized schedules in minutes. With built-in templates, a clean drag-and-drop system, and a central communication platform, everyone has a clear picture of what’s needed to get the job done.

Now that you have a schedule created, it’s quick and easy to see who’s working what hours and how much they’re getting paid. The time tracking software connects with your payroll, automating processes and giving you a clear picture of your costs.

The more schedules you create, the easier it becomes because of the templates. If you’ve recently done a similar job to the one you’re currently quoting for, then you can bring up an old template, edit as needed, and immediately see your labor costs and overhead rate.

Job Costing Use Cases with ZoomShift

1. Catering Company

Catering companies take on jobs of all shapes and sizes. One day they can be catering for a 1,000 person event, the next an intimate 8 person meal.

To do this efficiently, they’ve got to be able to cost their jobs well and they’ve got to be on top of scheduling.

With a multi-talented workforce, it’s vital that they have the right mix of people at each event. When they’re working with a mixture of full-time and part-time employees, this can be complicated.

ZoomShift takes the uncertainty out of scheduling and facilitates clear communication.

Not only does the app allow for easy scheduling, but it also helps employees with reminders and notifications to make sure they know exactly where they need to be. Other features such as a GPS time clock make it easy for everyone to clock in and get paid for their time.

With simple scheduling and automated timesheets, you have a much clearer picture of how much each job is likely to cost.

2. Construction Company

Construction companies may have multiple jobs going on at the same time, with employees constantly out on different sites.

Without the right software, this can make it very difficult to keep track of labor costs.

You need to know exactly who is working when and be confident that your timesheets are accurate. With GPS time clocks allowing employees to clock in from anywhere (GPS data allows you to make sure they’re clocking in when they’re on-site) and timesheets that automatically sync to your payroll, running a busy construction company becomes that bit easier.

ZoomShift allows you to keep track of your workforce, helping you to coordinate it better and understand your costs in more detail.

3. A Wide-Range of Industries

It’s not just catering and construction where it’s important to accurately cost jobs.

Scheduling and timekeeping is a vital part of business, but too often, it’s not done efficiently. Technology is changing this though, and it’s easier than ever to understand your labor needs for any given job, helping you to draw up more accurate job costs.

With its easy scheduling and automated timesheets and payroll, ZoomShift is the ideal tool to help you perfect your job costing.

JD enjoys teaching people how to use ZoomShift to save time spent on scheduling. He’s curious, likes learning new things everyday and playing the guitar (although it’s a work in progress).