A work schedule maker designed for hourly employees.

Build your work schedule in minutes, track time off, reduce labor costs, and have confidence your team will show up on time.

No cost. No catches. Manage up to 20 employees for FREE

Scheduling App

Time Tracking

Employee Time-Off Tracking

Shift Swapping

Shift Planning

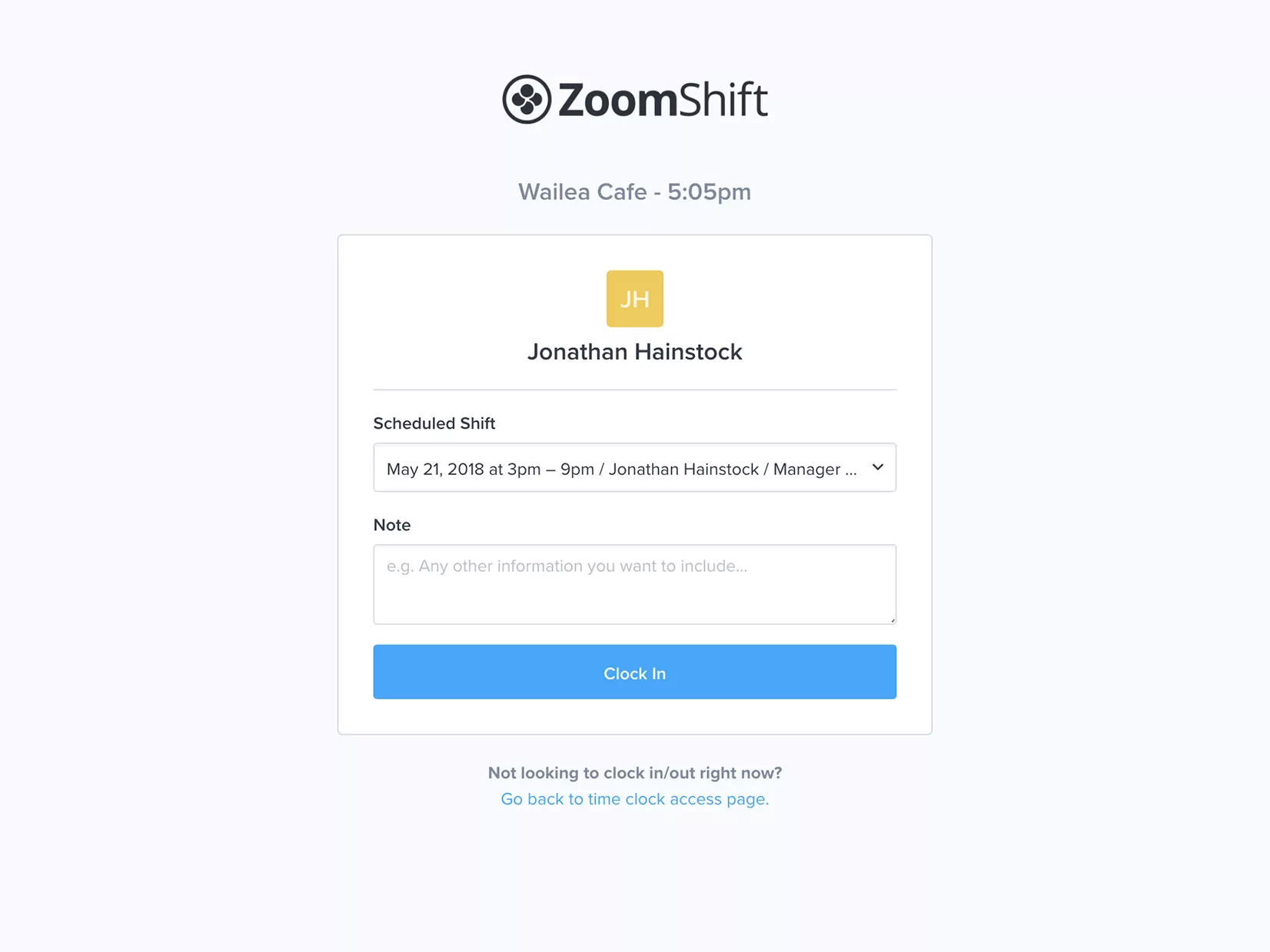

Time Clock

ZoomShift helped us save money on payroll and gave me more time to invest in building the business.

Retailers cut labor costs with ZoomShift.

ZoomShift is loved by small retail shops, retail franchises, and departments of larger organizations.

We love ZoomShift – it's super easy. With the app, our staff always knows when they work.

Our scheduling software is loved by national and local restaurants.

Whether you manage an indie restaurant or a national franchise, the ZoomShift employee scheduling tool can help you save time and money.

I love how simple scheduling is with ZoomShift. It just works.

ZoomShift simplifies shift scheduling for food and beverage businesses.

Coffee shops, bars, breweries, food trucks, frozen yogurt shops, and hundreds of other small businesses save hours with ZoomShift.

Who uses ZoomShift for Employee Scheduling?

Here are just a few industries that find ZoomShift’s employee scheduling feature useful:

- Restaurants

- Retail

- Services

- Healthcare

- Law Enforcement

- Firefighter

- Hospitality

- Education

- Franchises

- Nursing Homes

- Security Guard

- Call Center

- Volunteer

- Construction

- Salons

Universities, security teams, finance companies, physical therapists, caregivers, veterinarians, hospitals, and hundreds of others save time with ZoomShift.

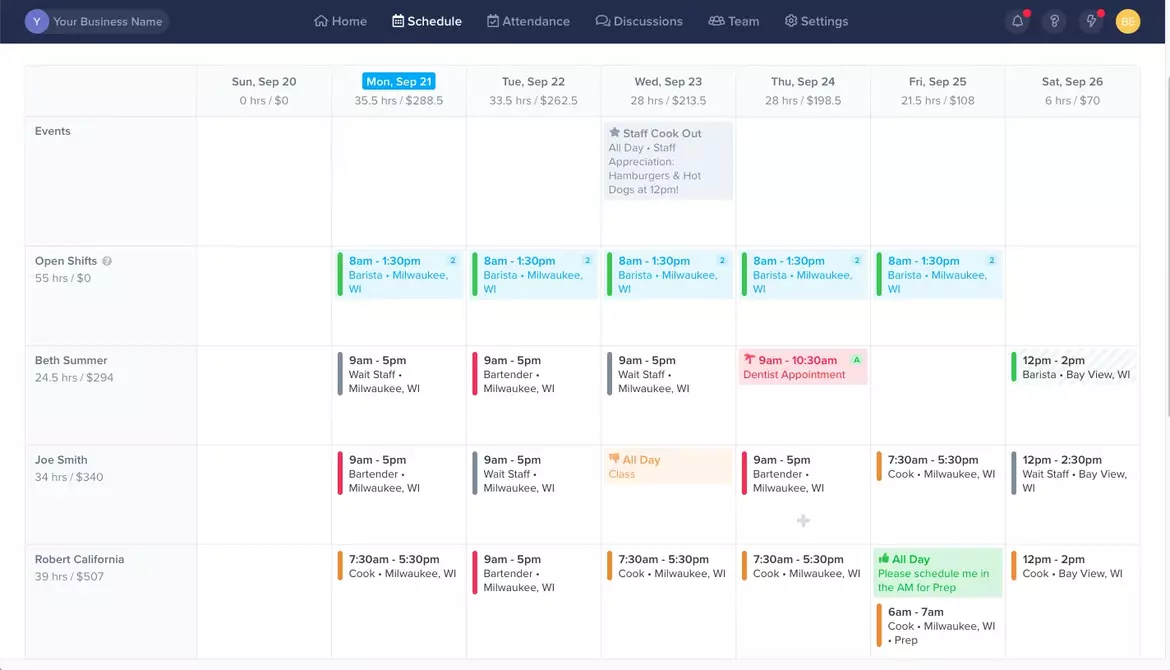

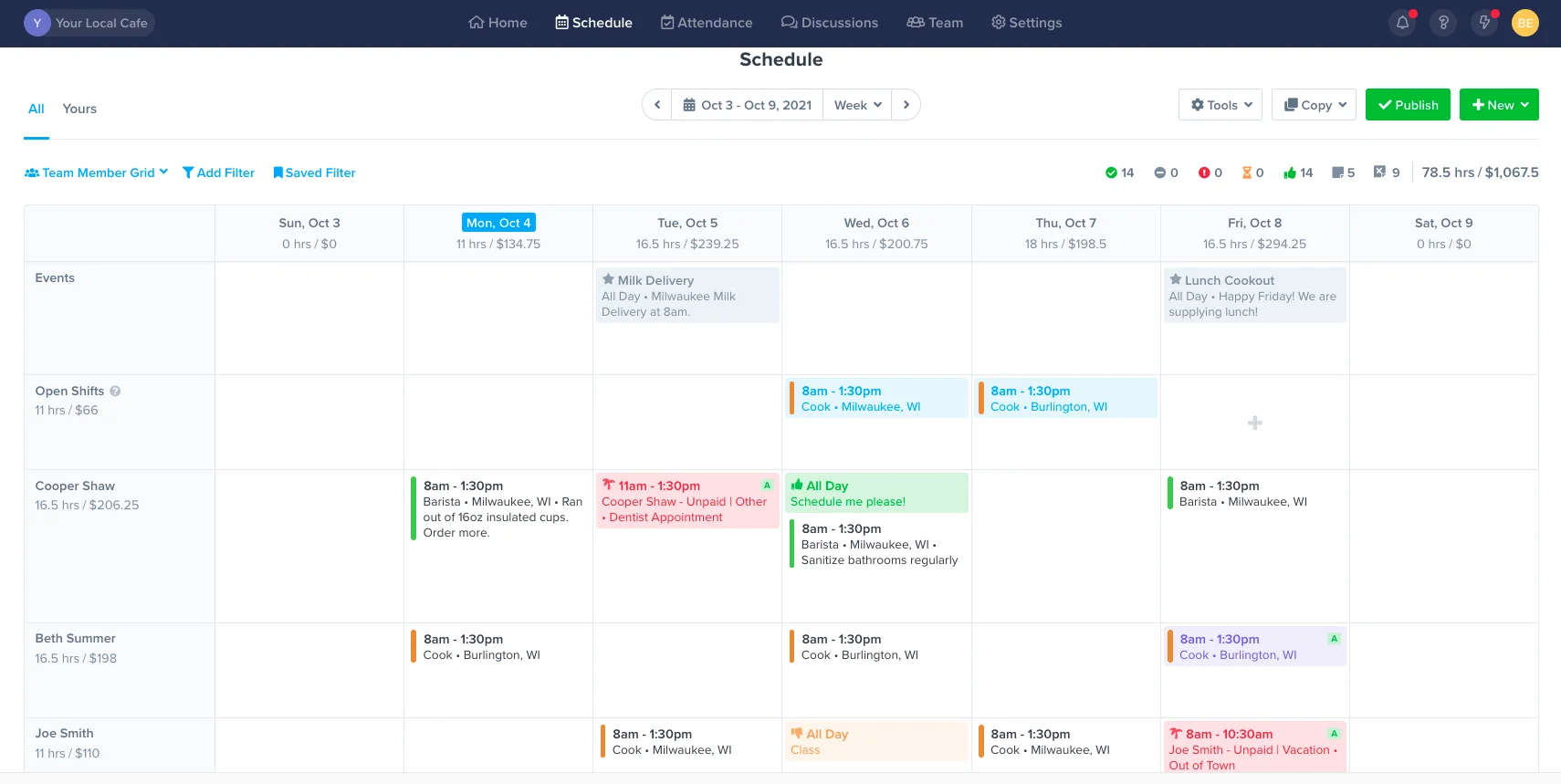

Stop using Excel, and make work schedules faster.

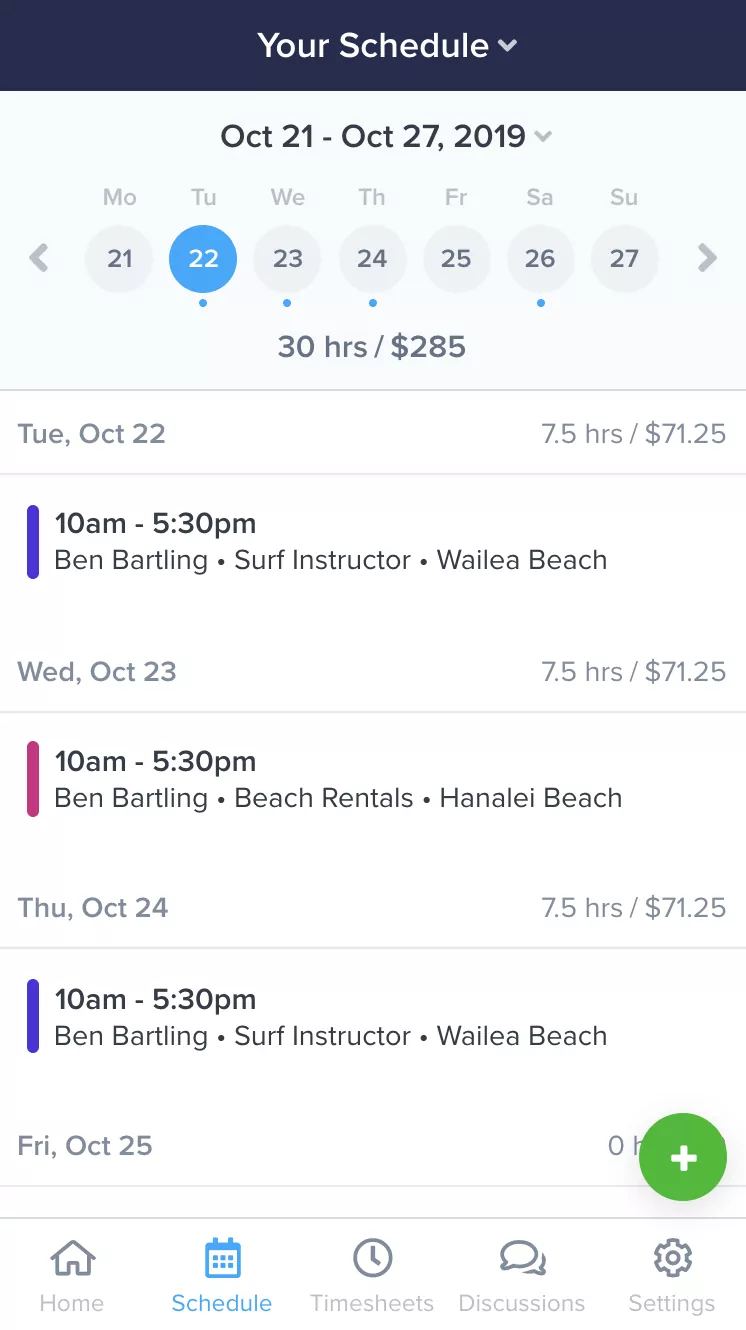

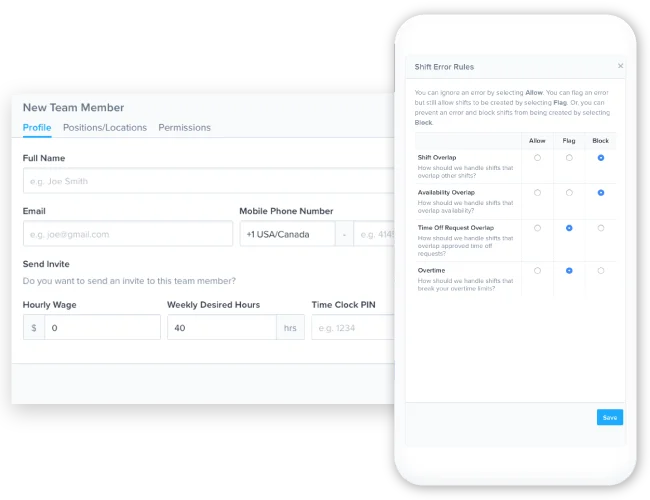

Get everything you need in one place – weekly schedule, availability, time offs, shift swaps. Use templates to build work schedules, fast.

Copy schedules

Use schedule templates to schedule in minutes. Drag and drop shifts in place on the calendar.

Improve staff accountability

Share schedules through text, push, and email messaging. Automatically remind team members before their shift starts.

Everything in one place

Invite your team to view their schedules, set employee availability preferences, set work hours, request time off, and pick up open shifts.

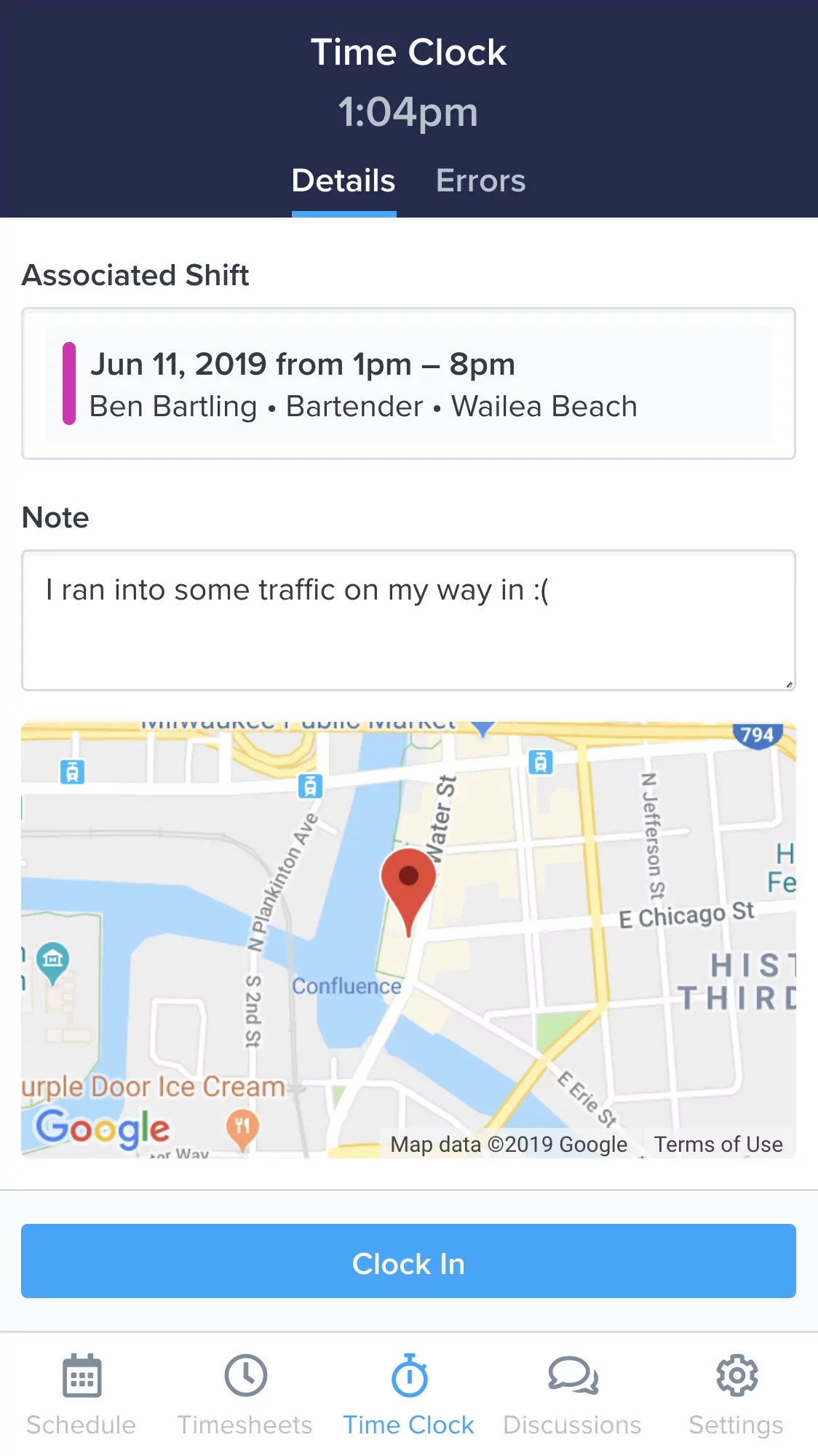

Track time from anywhere.

Spend less time on payroll and time tracking. Get all of your timesheets online where you can export them easily.

Learn MoreTrack time easily

Use our free web and mobile time clocks to track hours. No clunky extra hardware. Track GPS and whitelist IP addresses. Our employee scheduling software is a one-device solution.

Save on labor costs

Avoid costly timesheet errors before they happen. Block early clock-ins, block overtime, and fix missed punches easily.

Run payroll faster

Customize your payroll report to export all the necessary information and none you don't.

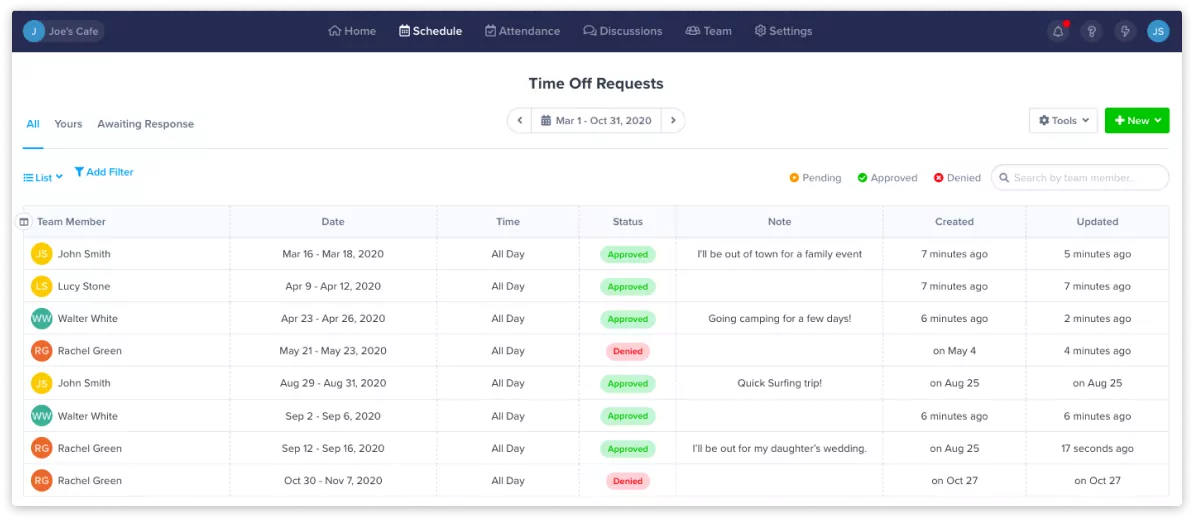

Manage time-off tracking all in one easy-to-use platform.

Say goodbye to the tedious process of creating work schedules by hand in Excel and Google Sheets. ZoomShift’s work schedule maker is designed to help businesses save time and money by automating the scheduling process.

Seamless time-off request

Employees can submit time-off requests directly through ZoomShift’s web and mobile app. Approve or deny those requests with just a few clicks even on the go.

PTO tracking & accrual

Easily keep track of PTO balances for your team, whether an annual allowance or accrual rate. Your leave management will be a lot easier and more transparent.

Simple approval system

Save time by setting a minimum of days’ notice and limiting time off requests on your busiest days. Be notified in real-time and even set an automatic approval process.

Everything you need to manage your team is in your pocket.

Make changes to the work schedule and timesheets on the fly. Empower your team to collaborate anytime, anywhere. ZoomShift's free apps for iPhone and Android keep your team in sync and put you at ease.

Learn MoreOur employee scheduling app helps you control labor costs.

With ZoomShift’s employee schedule maker, you can reduce your labor costs by making instant schedule changes to accommodate your busiest days and cut back on slow ones. Our easy-to-use forecasting functionality lets users compare their static budget in real-time and alert them when there are costly conflicts between employee shifts or availability for overtime work. Management can reorganize team schedules accordingly, saving time and helping you manage your budget effectively.

Start Free Trial

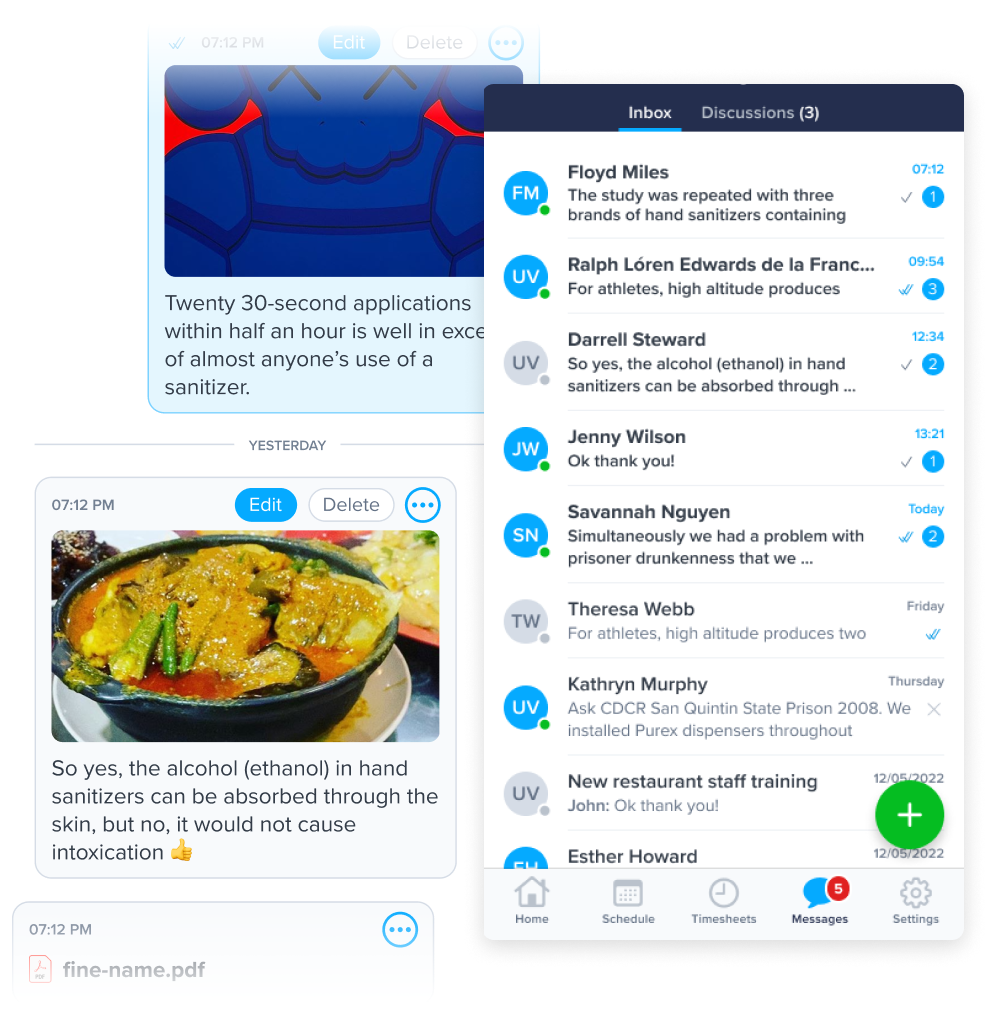

Take efficiency up a notch with ZoomShift Team Communication

ZoomShift's team communication feature takes team communication up a notch. It facilitates everything from quick event announcements to sharing crucial shift swap details, ensuring no one misses out on important updates. Team communication supports private, group, or company-wide messaging, and is not limited to text — share images, PDFs, other documents, and even GIFs for a touch of fun. Plus, the automatic addition of new employees streamlines onboarding. And with read status indicators, privacy controls, and automatic removal of former employees, ZoomShift's team communication ensures secure, professional, and effective communication for your entire team.

Start your free trial today.

Spend less time on staff scheduling and more time investing in your business.